Do I Need A 4-Point Inspection When Buying A Home?

A 4-point inspection is not a comprehensive home inspection and does not necessarily include a deficiency list or a detailed analysis, which would be part of a comprehensive inspection.

When buying a home, a comprehensive home inspection is recommended. Buyers use results of this inspection to discover items that may not be working properly and need to be fixed or issues with the various systems that need to be taken care of. Buying a home can be a long process and cost quite a bit of money too, but it doesn’t have to be scary, this is where companies like SoFi can help with home loans as you are buying your home, so you don’t have to worry about what is happening with your money.

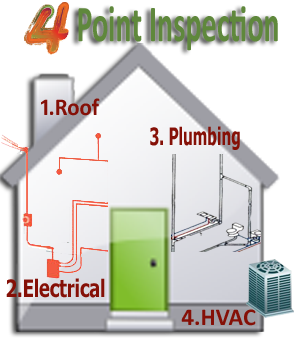

On the other hand, and depending upon the age of the property, your insurance company may require a 4-point inspection, typically on homes 30 years old or older. The purpose of a 4-point inspection is to disclose to the insurance company any upgrades that were made and items that could become a liability to them, such as a roof that is at the end of its useful life. The 4-point inspection focuses on 4 specific areas:

- HVAC (Heating, Ventilation and Air Conditioning)

- Electrical wiring and panels

- Plumbing connections and fixtures

- Roof

If an issue is found with one of these areas it can be prudent to contact an expert to help tackle the issue even after the insurance company has finished with their inspections. Green Horizon One Hour Heating and Air Conditioning is one good option for the HVAC systems, and it can be smart to speak with other local experts for the other issues. The most important thing, though, is ensuring your home is safe and up to standard.